There are many reasons why someone may need life insurance, but the simplest question to ask to determine if they do is: Does anyone in their life benefit from or need their financial support? This could be a child, spouse, aging parent, business partner, or even the co-signer on a student loan who would get stuck with the debt if they weren’t around to pay it off.

If your client's answer is yes, they likely need life insurance.

Does your client need life insurance?

Should something happen to your client, life insurance ensures their family is protected financially. Having a policy is important for anyone with dependents, and has become even more pivotal during the COVID-19 pandemic.

According to a study conducted by LIMRA, 42% of American households would struggle financially if a wage earner died unexpectedly, and 31% are more likely to buy life insurance due to COVID-19.

Whether your client needs life insurance depends on their individual circumstances. Take a look at the table below to determine if your client someone who needs life insurance.

If your client is a... |

They may need life insurance because: |

|---|---|

| Parent | Life insurance helps with the everyday expenses of raising a child and saving for college tuition and other milestones. |

| Spouse | Life insurance guarantees they're covered for any shared expenses or loans. |

| Student | Federal student loans are forgiven if the borrower dies but private student loans transfer to the co-signers. Life insurance protects your client's loved ones from that debt. |

| Entrepreneur | Your client can name a business partner as a life insurance beneficiary. Proceeds can be used to keep the business running or buy out the deceased's shares. |

| Caretaker | Whether your client cares for an adult child, an aging parent, or someone else, life insurance helps their loved ones find new aid if something happens to your client. |

How much life insurance does your client need?

To calculate how much life insurance coverage your client needs, Policygenius’ experts recommend you multiply your client's income by 10 to 15 times as a starting point. However, coverage should encompass all of your client's anticipated financial obligations, including debts, children, or aging parents.

Learn more about calculating how much life insurance your client needs

Does your client need life insurance if they don’t have any dependents?

You may not think it’s worth talking about buying life insurance while your client has no dependents. But getting life insurance when your client is young can save them money.

“If someone knows or expects they will have an insurable need soon, we recommend locking in coverage while you are younger and (usually) healthier,“ says Patrick Hanzel, certified financial planner, and Advanced Planning Team Lead at Policygenius. “We recommend owning coverage as you would five years from today.“

Each year your client delays buying a policy, the average cost of premiums rises by 4.5% to 9%. Take a look at the average term life insurance rates below to see how they increase by decade.

Age |

Sex |

$250,000 |

$500,000 |

$1,000,000 |

|---|---|---|---|---|

| 25 | Male | $17.12 | $26.88 | $44.73 |

| Female | $14.18 | $21.08 | $33.71 | |

| 35 | Male | $18.80 | $30.21 | $51.69 |

| Female | $16.50 | $25.43 | $42.69 | |

| 45 | Male | $35.47 | $60.79 | $113.01 |

| Female | $28.80 | $47.88 | $86.81 | |

| 55 | Male | $84.51 | $151.26 | $284.98 |

| Female | $61.19 | $108.81 | $207.79 |

Methodology: The chart above reflects rates, as of June 2, 2022, for male and female non-smokers in a Preferred health classification with a 20-year term length. Rates are based on the monthly Policygenius Life Insurance Price Index. Prices in the index are determined by internal actuarial rate tables for 10 life insurance carriers that offer policies through the Policygenius marketplace: AIG, Banner Life, Brighthouse, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and TransAmerica.

- Can your loved ones afford the cost of an unexpected funeral or medical expenses if you die? The average funeral costs more than $7,000. Your client's beneficiaries can use the death benefit to cover those expenses. If your client becomes sick or injured and needs medical care, the benefit can go toward any costs that health insurance does not cover.

-

Did someone co-sign a loan for your home or car? Just like a student loan, they’ll be responsible for the remaining balance if your client dies. A life insurance death benefit can cover that outstanding debt for your client's co-signer as well.

- Do you plan to have children in the near future? Many people wait until their children are born to purchase life insurance. But if your client knows they want kids down the line, they can lock in a cheaper premium by buying a life insurance policy now.

Even if your client won’t need the full coverage amount to cover final expenses and debt, the remaining balance could provide financial security to their loved ones or even be donated to a charity of their choosing.

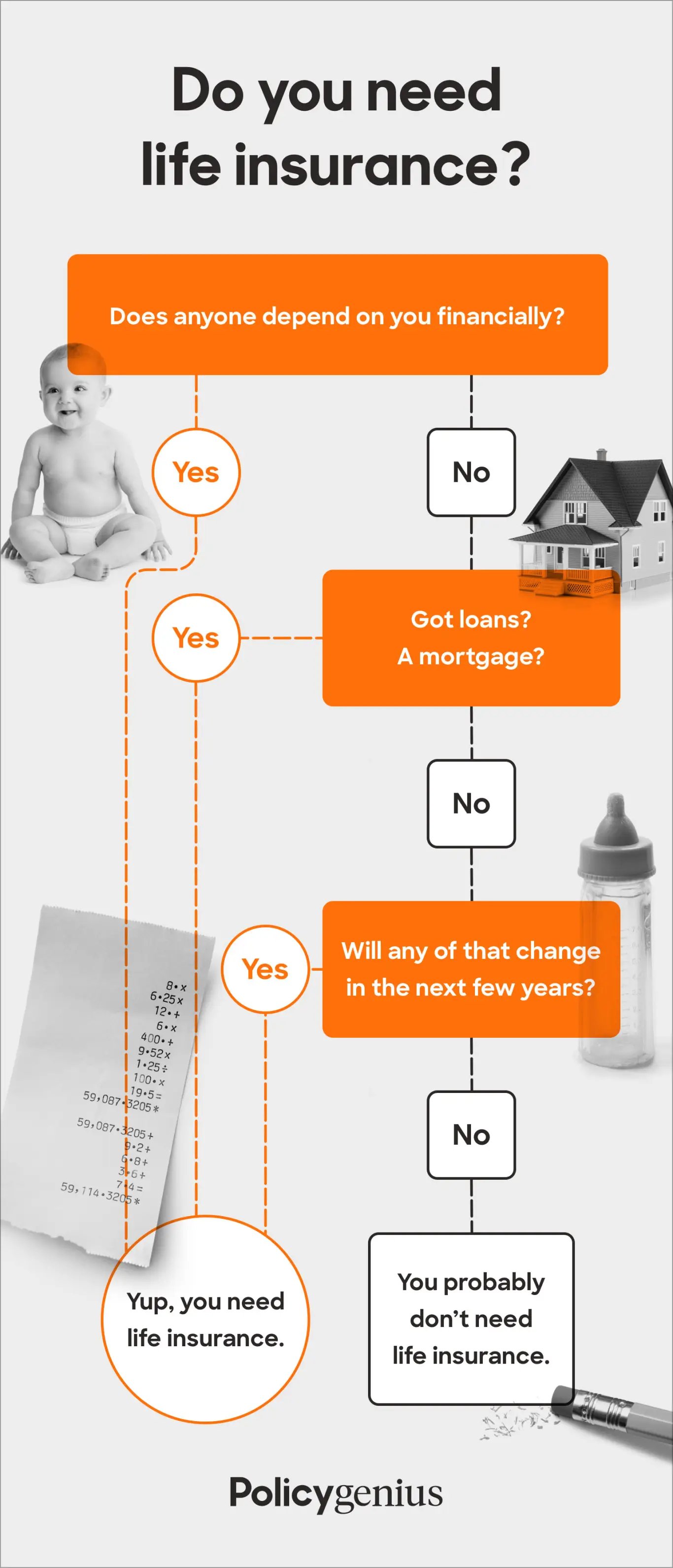

Still not sure if your client needs life insurance? Take a look at this flowchart to see where your client falls.