“Laddering” life insurance policies lets your client strategically decrease their coverage over time, ensuring they only pay for the coverage they need as their circumstances change.

As your client reaches major milestones in life, the amount of life insurance they need — and how much it costs — is going to change. We all become more expensive to insure as we age, so applying for a new policy later in life usually means paying more money for less coverage. At the same time, paying off a mortgage and settling other debts and financial obligations often means your client doesn't need as much coverage.

By laddering multiple life insurance with different coverage amounts and term lengths early on, your client can provide their loved ones with the right financial safety net while locking in the most competitive rates.

What is the ladder strategy?

To ladder life insurance means taking out multiple insurance policies with different coverage amounts and term lengths. Your client can intentionally stack these policies so they have the right amount of financial protection across different stages of their life.

The ladder approach applies only to term life insurance, which is the most popular type of life insurance because it's affordable, comes with few tax restrictions or limitations, and lasts only for the time your client needs it.

Your client can have multiple permanent life insurance policies, too. But since these don’t expire, your client can’t really ladder them, defeating the purpose of saving money using the laddering approach.

How to ladder your client's life insurance

At first, your client may need a larger death benefit to cover multiple facets of their life, from caring for their children to ensuring their student loan debts don’t fall on loved ones.

But as time goes on and your client's children grow up or their debts are paid off, your client may only need enough coverage to cover a few outstanding expenses, like a mortgage or final medical bills.

The ladder strategy is designed according to this principle:

-

As your client gets older, pays down bills, and increases their savings, their financial obligations decrease and they don't need as much life insurance.

-

Your client ladders multiple life insurance policies so that they expire at different times.

-

This ensures that your cilent is only paying for the protection they actually need and not the coverage they needed 10 or 20 years ago.

Questions or want to learn more?

How to save money with a life insurance ladder strategy

Life insurance policies are priced according to a few major variables:

-

How long the policy lasts: A 20-year term policy costs more than a 10-year term policy.

-

How much coverage your client wants: A policy with a $750,000 coverage amount costs hundreds more than one with a $500,000 coverage amount over its lifetime.

-

Your client's background: A person with a complicated health history will have a more expensive policy than someone without any health conditions, while younger applicants pay less than older applicants.

The ladder approach takes advantage of the first two variables by tapering off certain coverages when they’re no longer needed. Finally, it also takes advantage of the third variable by locking in low rates for each life insurance policy when your client is young and healthy.

The life insurance ladder strategy in action

If your client needs $1 million in life insurance over their lifetime, that doesn’t mean they need $1 million in coverage at every point in their life. Their expenses are higher when they're younger and have more financial responsibilities. As they get older and pay off some initial financial obligations, like a mortgage or their children’s college tuition, their coverage needs are likely to be lower.

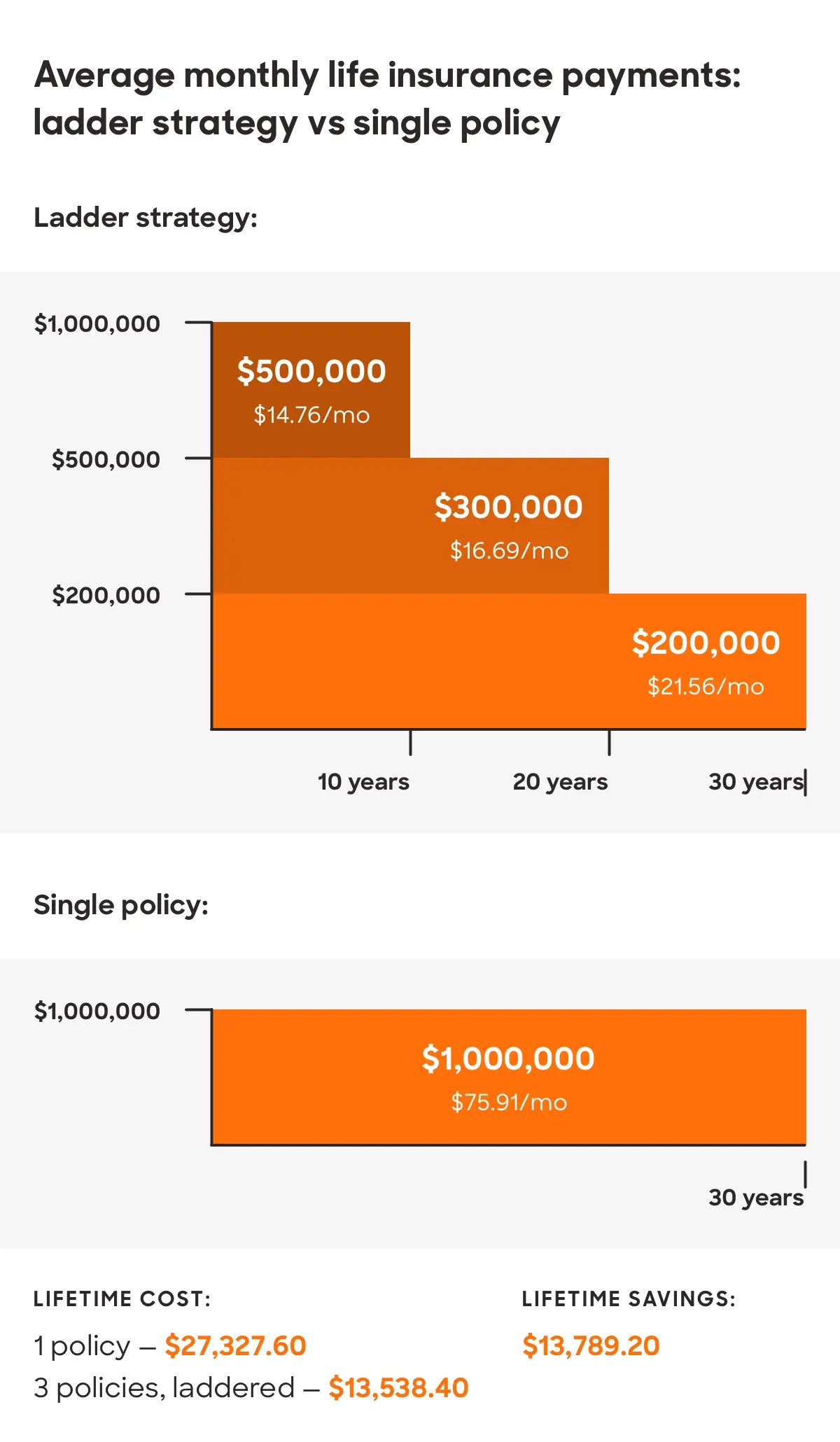

By laddering three separate term policies that equate to $1 million now and allowing them to taper off over time, your client is only paying the premiums when they actually need the coverage.

Here’s how it would work if your client were a 35-year-old male based on these three policies:

-

Policy 1: A 10-year policy of $500,000

-

Policy 2: A 20-year policy of $300,000

-

Policy 3: A 30-year policy of $200,000

Your client has a total of $1 million in life insurance now, and as they get older and need less protection, their coverage amount decreases. The example below illustrates what that means for your client's finances — and how much they'd end up saving. Even when your client has all three original policies in force simultaneously, the monthly cost of all three premiums combined is cheaper than the single monthly premium they'd have to pay for a $1 million policy with the same duration.

Laddered life insurance vs. a 30-year-term life policy

Below is an example of the difference in premiums between laddered policies and one 30-year term policy with the same total coverage amount.

Laddered life insurance monthly payments for $1 million total coverage

|

Ladder strategy |

Monthly premium |

|

$500,000 policy for 10 years |

$14.76 |

|

$300,000 policy for 20 years |

$16.69 |

|

$200,000 policy for 30 years |

$21.56 |

|

Total cost: |

$51.21 |

30-year term life insurance monthly payments for $1 million total coverage

|

Single policy |

Monthly premium |

|

$1,000,000 policy for 30 years |

$75.91 |

|

Total cost: |

$75.91 |

Methodology: Average rate estimates are for a 35-year-old male nonsmoker in a Preferred Plus health classification, based on approximations from 10 different carriers offered through the Policygenius marketplace. Rates will vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states.

How much can you save with a life insurance ladder strategy?

As the illustrated example shows, the ladder strategy can save you over 50% on your term life insurance by staggering multiple policies rather than buying one large policy.

Should your client use the life insurance ladder approach?

Laddering life insurance is a good financial strategy if your client knows what their future expenses entail — from mortgages to how many children they’ll need to provide for. By laddering life insurance policies, your client can save a lot of money in the long run — if they get a term policy to cover dependent care now and buy a policy with just enough protection to cover small expenses later on, even that smaller amount of coverage will be a lot costlier.

"Financial obligations and situations as a whole can, and often do, change over time. The goal is that over time your assets will increase and debts will decrease,” says Patrick Hanzel, advanced planning manager and certified financial planner at Policygenius. “Laddering is a good solution when there is a clear timeline for these changes. It will both save you premiums and provide the proper amount of coverage when it is needed.”

If, on the other hand, your client is unsure of what their finances are going to look like in the future, getting multiple life insurance policies isn’t a cost-effective financial strategy.

Laddering your client's life insurance has the potential to save them a lot of money if they can anticipate what their financial future will look like for the next 20 to 30 years.

Review how much life insurance your client needs

The amount of life insurance your client needs will depend on several factors, including if they have a spouse and whether or not they work, if they have dependents or plan to have children one day, and if they have any major liabilities (for example, a mortgage or student loans).

Most financial advisors typically recommend anywhere between 10 to 15 times their client's annual income in coverage. Another method is for your client to apply for coverage that costs about 1% of their annual income, so they can feel confident they'll be able to maintain the policy.

Revisit your client's life insurance coverage needs over time

Typically, it’s a good idea to review your client's life insurance coverage at major life milestones such as getting married, having a child, buying a house, or even switching jobs. This way you can ensure that your client doesn't have too much or too little life insurance coverage for their financial protection needs.