There are plenty of life insurance options out there, including new variations on traditional coverage, but most people end up deciding between traditional term and whole life policies, each of which has its selling points.

Term life insurance is affordable and straightforward but doesn’t last for life, while whole life insurance doesn't expire, but is more expensive. Term life insurance is right for most people, since they won’t need coverage in their retirement years, but that doesn't mean it's right for everyone. Whole life insurance is best for people with lifelong dependents or more complex financial planning needs.

What’s the difference between term and whole life insurance?

The main differences between term life and whole life insurance lie in the length of coverage and premium costs. Term life insurance usually lasts 10 to 30 years, then expires, whereas whole life lasts for as long as the insured keeps paying premiums.

Whole life insurance is much more expensive than term life insurance because of the longer coverage period and because it comes with extra features, like a cash value account that earns tax-deferred interest. Term insurance doesn’t have a cash value, which makes it less complicated.

For most people, the convenience and lower cost of term life insurance make it the best choice. But a whole life policy may be a better fit if your client needs lifetime coverage or another way to invest outside traditional accounts.

What is term life insurance?

With term life insurance, the insured pays premiums regularly for a set period. If they die while the policy is active, their beneficiaries get a death benefit payout.

After 20 to 30 years, many people have fewer financial responsibilities and don’t need life insurance anymore. As long as your client doesn't need coverage into old age, a term policy is simple and cost-effective.

Pros

-

Affordable premiums

-

Can cancel the policy without any penalty

-

No hidden fees, exclusions, or investment risk

Cons

-

Expires, so the insured has to buy a new policy if they still need insurance

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that stays active for the insured's entire life. Whole life is more complex than term life because of its cash value.

The policy's cash value grows over time at a rate controlled by the insurer. The cash value can be used to take out loans or for retirement when the account matures. Some restrictions apply to when the insured can begin making withdrawals and interest on policy loans.

Pros

-

Can be useful for estate planning

-

Cash value acts as forced savings

-

Coverage doesn't expire

Cons

-

Higher premiums are difficult to afford long-term

-

Other investments offer higher interest rates

-

Penalties apply if you cancel coverage

Questions or want to learn more?

Term life vs. whole life: Coverage comparison

Below is a quick overview of common term and whole life policy differences, including a cost comparison for 35-year-olds.

|

Policy features |

Term life insurance |

Whole life insurance |

|---|---|---|

|

Duration |

10 to 30 years |

Life |

|

Cost |

$25 to $30/month |

$481 to $571/month |

|

Guaranteed death benefit |

Yes |

Yes |

|

Guaranteed cash value |

No |

Yes |

|

How cash value grows |

N/A |

Earns interest at a fixed rate |

|

Premiums |

Level |

Level |

|

Risks |

No cash value savings option |

Low interest rates and high premiums |

Methodology: Estimated term and whole life insurance quotes based on policies offered by Policygenius in March 2022 from our 10 partner life insurance companies: AIG, Banner, Brighthouse, Lincoln, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica. Rates are calculated based on a $500,000, 20-year term life insurance policy and $500,000 whole life insurance policy paid up at age 99 for 35-year-old female and male non-smokers in a Preferred health classification.

Cost comparisons for whole vs. term life insurance

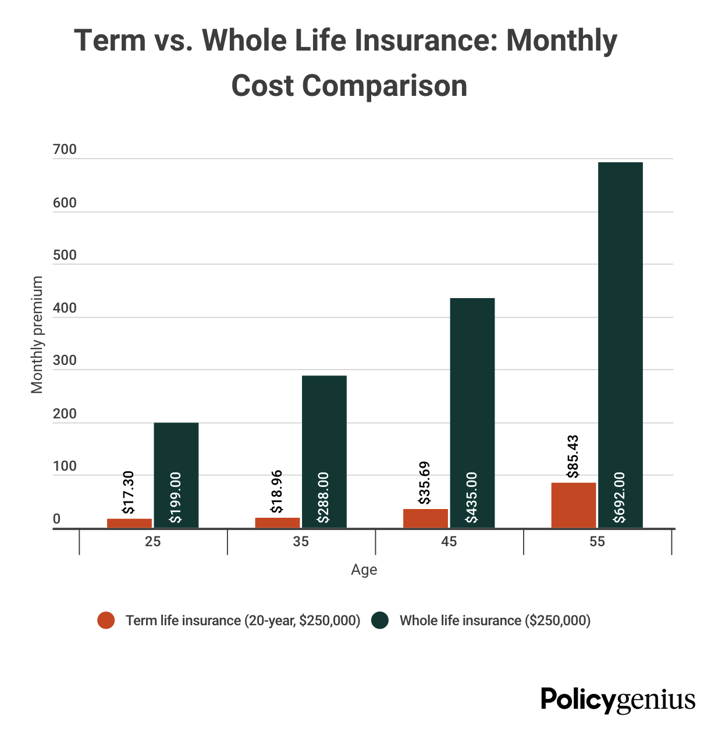

Both term life and whole life premiums stay the same for the duration of an insured's policy. Because coverage lasts longer and comes with a cash value, whole life insurance is five to 15 times more expensive than a comparable term life policy.

The charts below compare the monthly cost of a $250,000, 20-year term policy, and a $250,000 whole life policy for a male non-smoker at different ages.

|

Age |

Term life |

Whole life |

|---|---|---|

|

25 |

$17.22 |

$199.00 |

|

35 |

$18.95 |

$288.00 |

|

45 |

$35.72 |

$435.00 |

|

55 |

$85.40 |

$692.00 |

Note that a whole life policy costs as much as 15 times more than term life in the example above for the same death benefit. Visualized another way, the difference in cost is even clearer:

Methodology: Quotes based on policies for male non-smokers in a Preferred health classification, offered by Policygenius in March 2022 from our 10 partner life insurance companies: AIG, Banner, Brighthouse, Lincoln, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica. Rates are calculated based on a $250,000, 20-year term life insurance policy and $250,000 whole life insurance policy paid up at age 99 for a 35-year-old male non-smoker in a Preferred health classification.

How to choose between whole life and term life insurance

Whether your client needs a term life or whole life policy depends on their financial needs.

-

Term life is right for your client if: They want an affordable way to leave a death benefit behind to financially support their loved ones and they expect to self-insure in the future

-

Whole life is right for your client if: They want to minimize their estate tax, they want to build cash value, or they have long-term dependents

Term life insurance is the right life insurance policy in most cases because it offers the same amount of death benefit as whole life insurance for a fraction of the price.