When a proposed insured (PI) applies for life insurance, they are assigned a health classification based on their application details. If they present fewer insurance risks — like complex health conditions, risky habits, or dangerous hobbies — they'll get a better classification and more affordable rates than someone who raises some flags.

Life insurance companies use roughly the same four classifications to determine an individual's premiums. But, each company varies slightly in how they assign those classifications. For example, while it’s common to receive a lower classification for any tobacco use, some providers give infrequent cigar smokers a better classification than casual cigarette smokers.

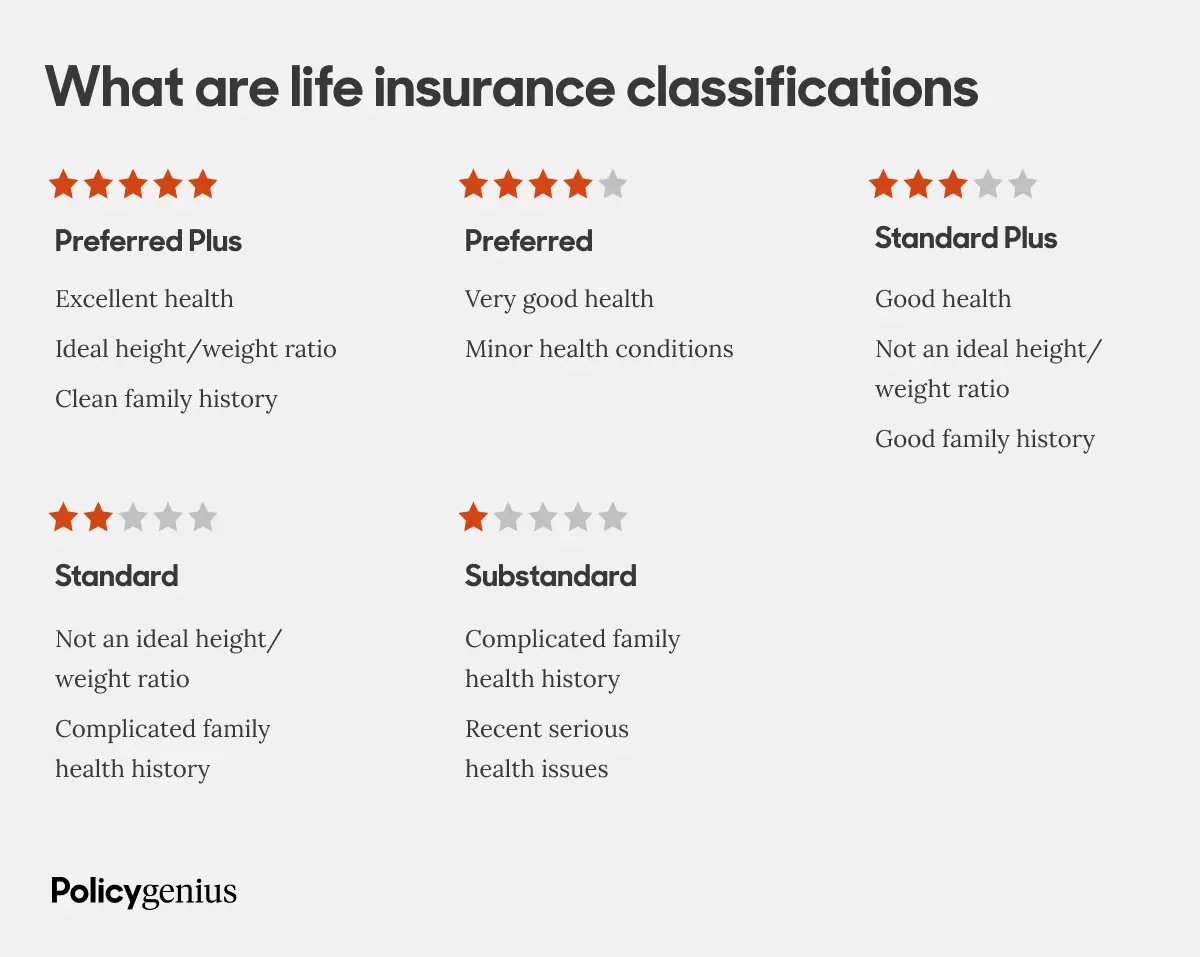

What are the different health classifications?

The four life insurance health classifications are:

-

Preferred Plus

-

Preferred

-

Standard Plus

-

Standard

People with more complex medical histories may fall into a broader category called Substandard or Table ratings. Providers also have health classifications exclusively for smokers, which come with significantly higher rates.

Preferred Plus

Sometimes called Preferred Elite, Super Preferred, or Preferred Select, this is the best classification a PI can get and comes with the lowest premiums. It means the PI is in excellent health, their height-to-weight ratio falls into the insurance company’s desired range, and their family history is as squeaky clean as their lifestyle.

Preferred

Outside of a few minor factors, like high cholesterol or high blood pressure, the PI is in very good health. They won’t get Preferred Plus rates, but their premiums will still be very competitive.

Standard Plus

The PI is in good health, but they might have a few outliers to keep an eye on or their height-to-weight ratio doesn’t fall into the insurer’s range for Preferred classifications. Their family history is unremarkable, so they shouldn’t have any surprises in their future.

Standard

A common difference between Standard and Standard Plus is that the individual's family history plays a role, and their family members probably had medical issues before age 60. They will see higher life insurance premiums in this class, but they're still able to get insured.

Table ratings

This isn’t a specific rating classification like the others; instead, based on an individual's health history, they're placed in the Substandard category, which is graded by either letters or numbers (typically A to J or 1 to 10). This reflects a complicated health history or recent health issues, such as a heart attack.

The PI's premium will, on average, be the Standard price plus 25% for every level down the table ratings:

-

A = Standard + 25%

-

B = Standard + 50%

-

C = Standard + 75%

-

D = Standard + 100%

-

E = Standard + 125%

-

F = Standard + 150%

-

G = Standard + 175%

-

H = Standard + 200%

-

I = Standard + 225%

-

J = Standard + 250%

The PI could pay an extra 250% on their premiums at a Table J/Table 10 health classification, which isn’t ideal. But they can still get insured and provide for their dependents when they die.

Questions or want to learn more?

How are life insurance classifications determined?

Insurance companies look at a wide range of health and lifestyle factors during underwriting to set an individual's classification, including:

Health status

The PI will have to take a medical exam — unless they qualify for accelerated underwriting — and answer questions about their health. This includes:

-

Medical conditions

-

Prescription history

-

Treatment for existing conditions

The insurance company might also request an attending physician’s statement (APS) from their doctor to learn more about their health history.

Height and weight

Each life insurance company has its own Build Table that places the PI in a health classification based on height-to-weight ratios, similar to a BMI (Body Mass Index) measurement. While each company’s table is different, a PI is more likely to receive higher rates if, according to the CDC guidelines, they are considered underweight, overweight, or obese.

Insurance companies also consider a PI's weight history. Losing weight can help the PI save money on their life insurance premiums, but they won’t benefit much from sudden or short-term weight loss.

Tobacco use

Smoking, using chewing tobacco, or vaping will significantly raise an individual's rates; smokers pay up to three times more for life insurance than non-smokers.

Here’s how smoking affects a PI's health classification:

-

Preferred Smoker: The PI would probably fall into the Preferred classification if they didn’t smoke. This will usually apply to occasional smokers or people who use smokeless tobacco.

-

Standard Smoker: The PI would otherwise fall into one of the Standard classifications. If they want premium savings, they need to kick their smoking habit (for at least a year) before applying for life insurance.

While quitting smoking can decrease the cost of an individual's life insurance over time, ex-smokers will still see an initial hike in their premiums. The longer a PI doesn't smoke, the more opportunity there is to get lower premiums when they apply for a policy.

Alcohol and drug use

Having a beer every once in a while won’t affect an individual's premiums, but insurance companies will have some concerns if they have abused drugs and/or alcohol.

Many major insurers offer non-smoker classifications to marijuana users, depending on how often they smoke.

Family health history

During an initial evaluation, a PI will likely be asked to disclose if anyone in their family has been diagnosed with, treated for, or died from:

-

Cancer

-

Diabetes

-

Heart disease

-

Kidney disease

Family health history is particularly important when it comes to conditions that can be inherited. If a PI's family has a history of illness, it will count against them, especially if a close family member died before age 60.

Lifestyle

This is a catch-all category that evaluates how risky the PI's lifestyle is based on details like:

-

Driving record

-

Hobbies

-

Occupation

For drivers, multiple moving violations will raise their rates, while DWIs within the last five years will result in a declined application.

If the PI is a base jumper or a fan of flying single-engine planes, their chance of premature death is higher than someone who likes to curl up with a nice book on the couch. They will either have an exclusion in their policy — meaning if their death is caused by a specific activity, their policy won’t pay out — or have a flat extra added to their premiums.

A flat extra fee costs about $2 to $5 for every $1,000 of coverage a policyholder has. That’s an extra $5,000 a year on a $1 million life insurance policy.

Criminal history

A misdemeanor isn’t going to hurt a PI's chances of getting life insurance; it probably won’t even affect the classification they receive. But if they have a felony on their record, they'll want to wait for as long as they can to apply for life insurance to avoid high premiums.

Each insurance company has its own criteria for determining how much each of the factors above affects a PI's classification. Insurers also allow some flexibility in assigning classifications based on other criteria, called stretch criteria. The different approaches to setting classifications mean a PI will probably see different quotes from company to company.

How life insurance classifications impact a PI's rates

A Preferred Plus classification earns the lowest rates, with prices increasing gradually for each classification from there.

A $500,000, 20-year term life insurance policy costs $25 to $30 per month for a 35-year-old non-smoker in a Preferred health classification and $77 to $93 per month for smokers. Compare that to $38 to $46 per month in a Standard non-smoker health classification or $101 to $129 in a Standard smoker classification.

While there isn’t a major increase if a PI falls one or two health classification levels, the gap widens significantly if you compare Preferred and Substandard classifications.

How to get a better life insurance classification

A PI's life insurance classification is the final determinant of how much they'll pay to protect their family. Here’s how they can increase their chances of a favorable classification:

-

Apply early: Life insurance rates increase by an average of 4.5-9% a year every year an individual puts off applying, so they'll save more the younger they are when they apply.

-

Improve your health: Some health factors, like an individual's family history, are out of their control. But if they maintain health improvements for a year or longer, they're more likely to get competitive rates.

-

Quit smoking: In the example above, a PI could save at least $63 per month — $15,120 over the life of a 20-year policy — just by going from a Preferred smoker class to a Preferred non-smoker class.

Even if a PI has a chronic illness, it’s not impossible to find a budget-friendly policy; for conditions like diabetes, insurers may work with a PI if they can show that they're managing the condition via medication and other recommendations from their physician.

Since every life insurance company weighs risk and assigns health classifications using different criteria, comparing rates from multiple providers will help PIs find the best policy for their needs.